I came to a realization a few months ago.

We talk about Buyer’s markets and Seller’s markets in real estate. Rare indeed is when we hear in the media about a balanced real estate market. Why? Well… for one thing, it doesn’t make a great story. “This just in…the real estate market in Toronto is in perfect alignment. There is equilibrium between Buyers and Sellers and everyone is happy… more at 11.” Probably not going to happen. The realization was this: I haven’t really seen a balanced market in the time I have been in real estate. Well, that isn’t exactly true.

There are a number of definitions of a balanced market, but some of the commonly accepted norms are:

- A market in which the sales to active listing ratio is in the 14-20% range.

- A market where home prices remain relatively stable.

- A market where there are between 90 and 180 days of inventory available (3 to 6 months).

- A market in which 40-60% of new listings (by volume…not necessarily the listings themselves) sell in a given month.

While these all use somewhat different metrics, they point in the same direction. Relative calm. People are not tripping over each other to get in on the deal, but nor are Sellers wondering when the next Buyer will darken their door, and not try to take their first born in the offer process.

We did have that in our area a couple of years ago. But it felt like it lasted a week before the market swung right through balance and firmly into a Seller’s market. So, perhaps my realization is best stated in a general sense. A balanced market is something you shoot through on your way to an imbalanced market.

With the change in the market, must come changes in the strategies that we employ to best provide professional real estate services to our clients. Some of the differences are obvious, but some are more subtle.

Conditions in offers used to be par for course up here. No one would dream of making an offer that didn’t have conditions on satisfactory home inspection, ability to finance, obtaining insurance, making sure the deck complied to local zoning ordinances, and verifying the varietal of grasses in the lawn (OK…I made that last one up). This in addition to the bevy of warranties. Warranties on septic systems, availability of potable water, working order appliances, and a warranty that the building and improvements fell within the setback requirements of the municipality were completely commonplace. The schedule “a” to the agreement of purchase and sale could often be 2 and even 3 pages long. This was deemed prudent protection for the Buyer. It still is prudent. Problem is, what Seller in their right mind is going to accept that list when they have 4 other great offers lined up without conditions to buy their place? The answer is 0.0%.

This is not to say that we have done away completely with conditions in offers, but where we could load up an offer with protection for the Buyer a few years ago, now we have to take a different tact. It is not uncommon for a Buyer now to bring a contractor or inspector with them on a viewing. Where it was taken somewhat for granted a few years ago, Buyers are nailing down their financing well in advance (conditionally of course). In short, Buyers are sacrificing some of the protection afforded to them by conditions at the altar of actually getting a house!

Buyers are doing what they have to to get their offers noticed. When we routinely see 2, 3, 4, 5, 10 offers on a property, differentiating yourself can often make a difference. We see deposit cheques attached to offers for huge amounts. If you have 4 offers that are relatively similar, but one has 100k deposit and the rest have 5k, which is the one most likely to be accepted? Buyers are adding personal context to offers as well. Hand-written notes telling the Seller about the Buyer’s family, and telling them how much they love their property can make the difference between a deal and another loss in the multiple offer marketplace.

Many of you will think this last strategy is an invention. It is a money game right? At the end of the day, the highest bid will-win right? Not necessarily.

As broker of record, I can give you example after example where money was not the final decision-maker. I sat in on an offer presentation by phone where the Seller was out of the country and had given power of attorney to his daughter to act on his behalf. There were 2 offers presented and the daughter called the father to go over them. They were relatively close, but one of the Buyers intended to rent the property out for a couple of years and then move in. The other Buyer had a young family that had been looking for ages for exactly this type of property. They loved it, they had no intention of changing anything, and were sincerely hopeful that they would be the successful proponent. The offers were $20,000 apart. The instructions from the father? “Sell it to the right person”. I am serious. This family loved the house they were selling and they were willing to take less money to make sure that the correct people got it.

Another great example is a story about a REALTOR® friend of mine. He was looking at buying a family cottage, and being a pro, he knew all the rules. The Sellers would be present, so don’t show emotion, don’t tell them how much you love the place, be cool. Well…that went to crap in the first 3 minutes of the showing. His daughters started fighting over these hanging bunk beds in the small bedroom off the kitchen. “I want that one….No…that’s mine”. What a nightmare. But the nightmare worked in his favour. The owner was moving out of the country. This house was a hot commodity, but the owner sold to my friend based partially on the fight the daughters had. She told him later that the whole thing “felt right” as she remembered when her family bought the cottage some 30 years before. She and her sister had had the exact same fight. You just never know.

As I mentioned in my last piece, it is tough for Buyers right now. REALTORS® lament how hard it is to represent a Buyer in a market like ours. I have to remind many of them what the other side of the coin looked like 5 years ago. If you had a Buyer, you were in position A. Sellers were frustrated. Well-priced, well-marketed homes were not selling. Buyers were influenced by external matters. The stock market, the Euro. There was no urgency at all in our market. At one point, we estimated we had 6 years worth of inventory in the $750,000 plus category. Crazy. Our sellers were justifiably irritable and we had to manage expectations like crazy. The shoe is on the other foot now.

This is not to say that Sellers don’t need good advice. I submit to you that the role of a REALTOR® is critically important in the process currently. If we define market value as the price that a willing Buyer will pay a willing seller, free of duress, and with adequate time and exposure to the market, you will see the opportunity afforded to a Seller who has excellent professional representation. This is a market where a great REALTOR® can truly add value to the process and put real money in the pocket of a Seller. I could (and may) write another entire article on the subject. A job well done today can often result in Seller price expectations being exceeded by a significant margin. We do love making people money!

I am often asked if I think that the current market is sustainable. I answer honestly that change is constant, and I do not have a crystal ball. However, there are certain market factors that make me bullish on a continued Seller’s market in our area. Demographics are chief among these. We are on the thin edge of the wedge of the baby boomers retiring, and we see a constant flow of amenity-seekers relocating here. I have no reason to think that this demand will ebb in the short to medium-term. New real estate product is being approved and introduced to the market, and I believe this will continue. However, I am not sure that inventory in the pipeline will meet and exceed demand.

Some in the media and some economists see fragility in the real estate market in Toronto, one of our primary feeder markets. They point to foreign ownership and naked speculation as a cause for the rapid and sustained increase in prices in the market. We have heard of houses sitting empty in Toronto and real worry about what this means for the market.

This is totally unscientific, but I took a poll of some of the pros in my offices. I asked them how many of their clients they feel are speculating on our little market (compared to the GTA). I was not surprised by the answer. Foreign investment in our area does not seem like a significant factor. The vast majority of Buyers up here are Canadian. We have not seen any evidence so far of speculation other than in the builder’s market. We have not seen any recently purchased homes going unoccupied. While there is significant pressure on investment real estate, we are not regularly seeing sub 5% capitalization rates.

This is not to say we are fully insulated. Not at all. But demography is on our side. People want to be here. We continue to see incredibly strong domestic demand, and we do not currently have a reason to see why that might change.

However, change is constant. Despite the fact that my generation has never known anything other than cheap money, it will get more expensive at some point. It may be a rude awakening for some. When the market changes, and it will, the adjustment will be interesting to watch. But we will adapt.

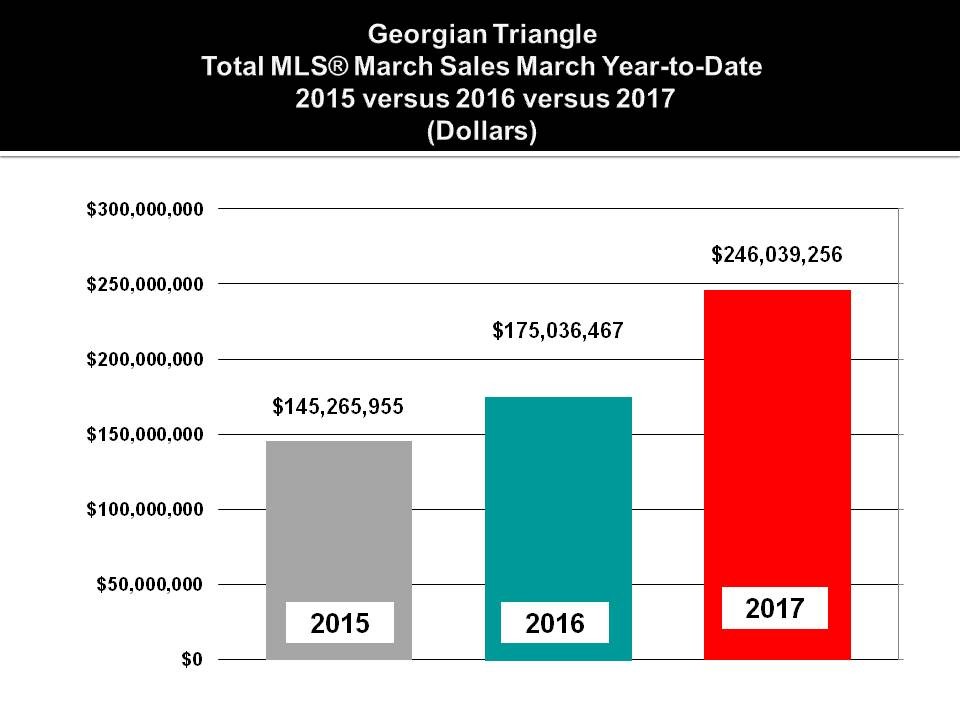

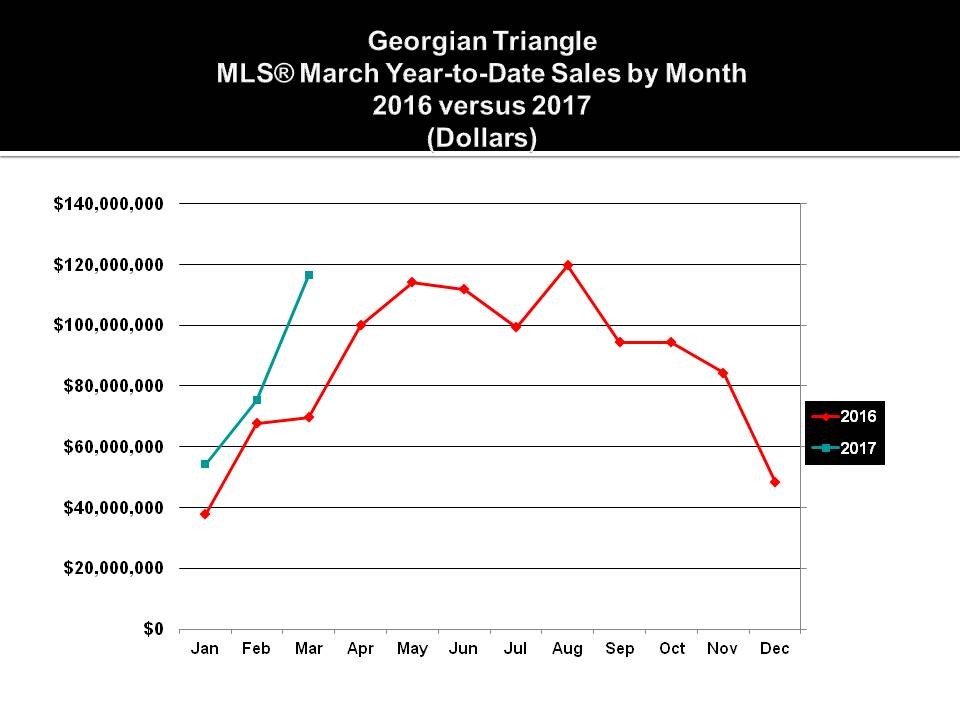

Following record sales which saw MLS® real estate sales across southern Georgian Bay break through the $1 billion barrier in 2016, demand for area properties in the first quarter of 2017 shows no signs of letting up notwithstanding there is an ongoing shortage of properties listed for sale.

First quarter MLS® sales as reported by the Southern Georgian Bay Association of REALTORS® totalled $246 million an increase of $71 million or 41% over the first quarter of 2016.

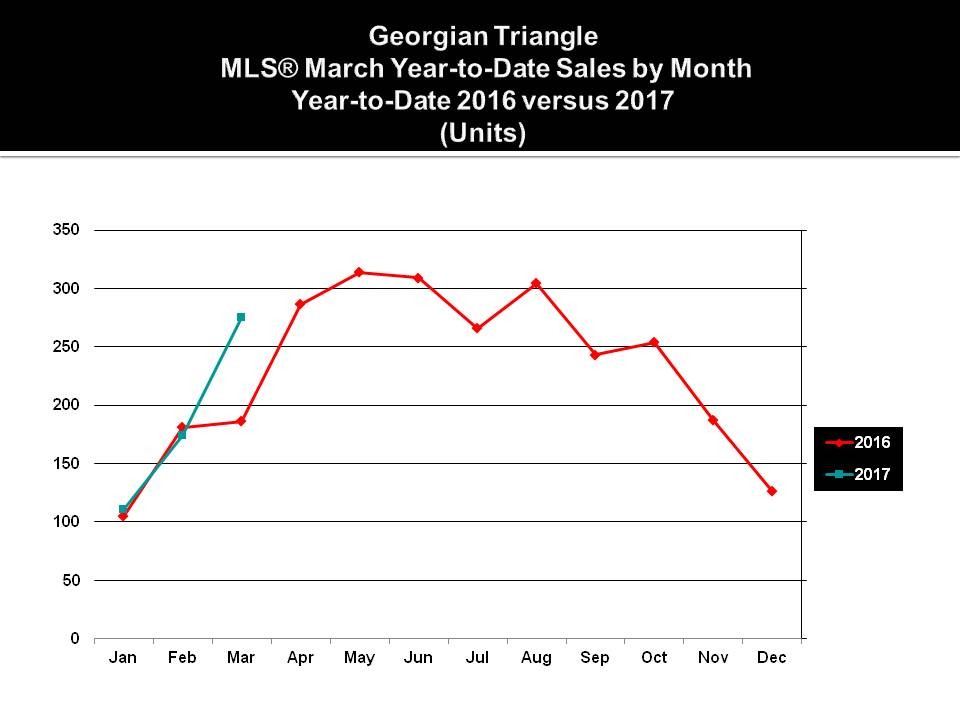

MLS® unit sales for the first quarter of 2017 saw 560 individual properties sold compared to 472 sales last year an increase of 19%. Conversely, the number of new MLS® listings that have come to market year-to-date to the end of March totals 748, down 21% or 200 less than the 948 MLS® listed properties than came on the market in the first three months of 2016. As we have stated for quite some time, the ongoing lack of inventory both locally as well as in many markets across Canada is the only real threat to residential property sales nationwide.

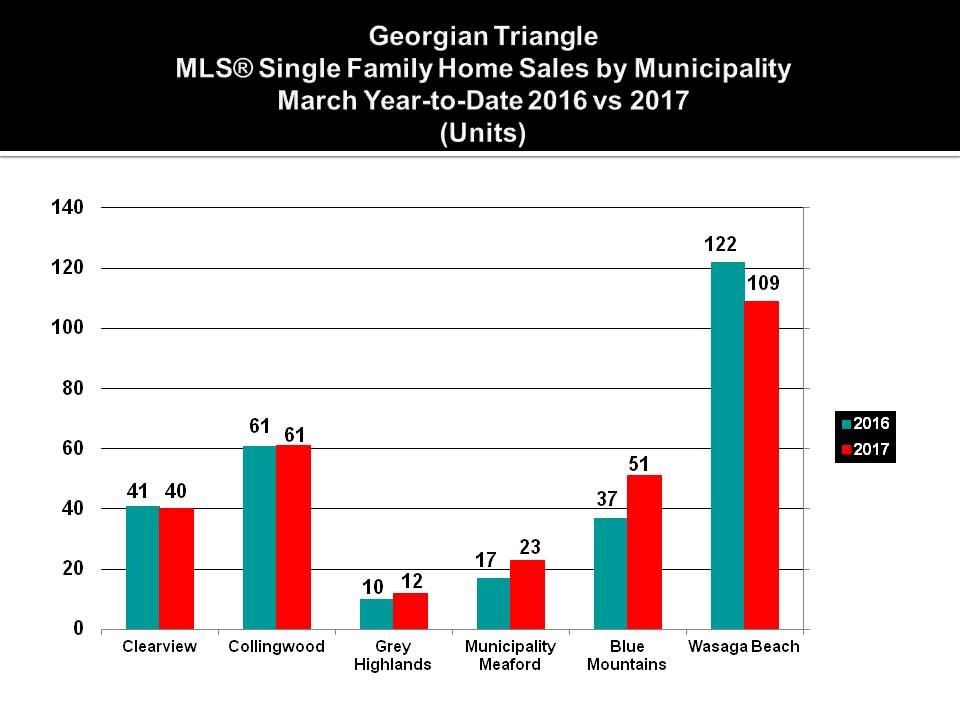

Not all area municipalities are experiencing the same level of sales growth and some of this stems from the lack of inventory. Year-to-date single family home sales are up a modest 7% to the end of March with 336 MLS® sales reported. Single family MLS® home sales in Collingwood are unchanged with 61 sales reported year-to-date while sales of 40 homes in Clearview Township is one less than a year ago. Home sales in Wasaga Beach are down 11% with 109 sales this year compared to 122 in 2016. Sales in other area municipalities are up as follows: Grey Highlands 20%, Municipality of Meaford 35% and the Blue Mountains 38%. MLS® condominium sales are up a modest 12% with 111 sales reported this year compared to 99 sales in the first quarter of last year. As we have pointed out in the past, the above mentioned results are for MLS® sales only and do not include the sale of new homes and condominiums made by builders and developer several of whom are selling out their projects very quickly.

Whereas single family home and condominium sales are experiencing modest growth, MLS® vacant land sales are up a whopping 159%. A total of 96 sales have been reported through the end of March versus just 37 sales during the same period last year. Over the past several years there has been a glut of vacant land inventory. Whether its the absence of available houses and chalets listed for sale or just a matter of personal preference, buyers are quickly gobbling up building lots at a pace unlike anything we have seen in recent years and this is especially true in the Blue Mountains where 57 sales represents 59% of the vacant land sales in the region year-to-date.

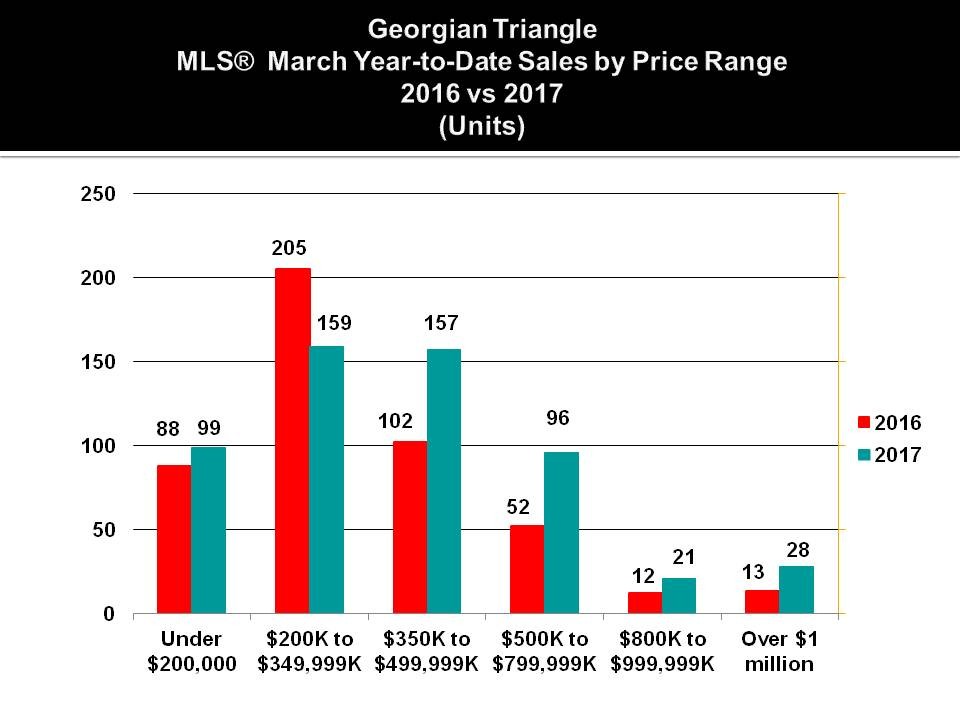

MLS® sales in total dollars continue to be driven in large part by the sales of higher priced properties. Sales between $350,000 to $499,999 are up 54% this year with a total of 157 sales reported. In the $500,000 to $799,999 category sales total 96 units an increase of 85% while sales between $800,000 and $999,999 of 21 properties represents a 75% gain from one year ago.

Lastly, sales above the $1 million mark are up 115% with 28 sales reported this year compared to just 13 in the first quarter of 2016.

Whether or not we can sustain the level of MLS® sales activity in 2017 that we saw last year remains to be seen. While the demand for area real estate across southern Georgian Bay shows no signs of diminishing, what remains to be seen is whether there is a sufficient supply of properties listed for sale to satisfy what appears currently to be an insatiable demand for area real estate. |E|