Boom to Balance

By James McGregor Sales Representative, CIPS* and Max Hahne Broker, IRES**, RSPS†,

Engel & Völkers McGregor Hahne Group

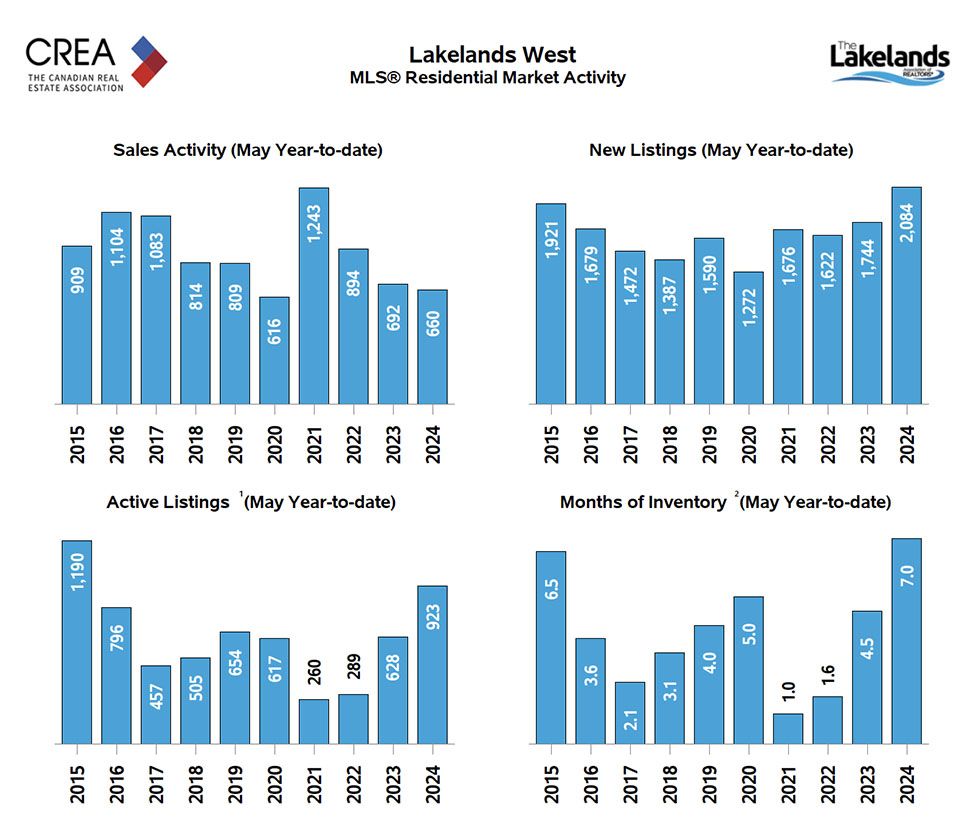

The real estate market in Lakelands West, which includes Clearview, Collingwood, Grey Highlands, Meaford, Blue Mountains, and Wasaga Beach, experienced a notable shift in May 2024. Sales for the month reached 176, marking a 15% decline compared to May 2023.

New listings surged to 593, resulting in 1,195 active listings on the market—the highest level since 2015. This increase in supply pushed the Months of Inventory (MOI) to 6.8 months. For context, MOI represents the time it would take to sell all current MLS® listings if no new listings were added.

Year-to-date sales for 2024 remained steady at 660, showing a slight decrease from the same period last year but a significant drop when compared to figures dating back to 2014. Active listings in the area reached 923, a number only surpassed in 2015 when the market saw 1,190 listings. The MOI for the year reached 7 months, the highest in nearly a decade.

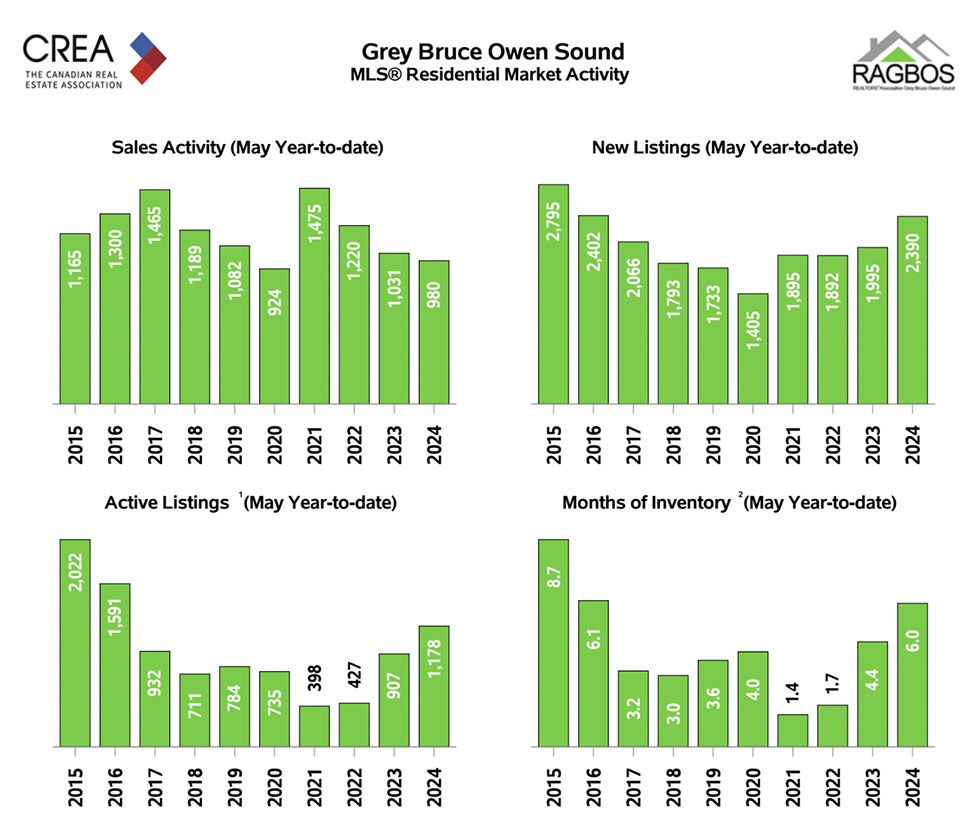

In Owen Sound and Grey/Bruce, the real estate market painted a different picture. May sales were 276, the lowest in a decade for the month, excluding May 2020. Despite the slump in sales, new listings for the month were robust at 685, the highest in the past eight years. Active MLS® listings stood at 1,510, a seven-year high, barring the pandemic year of 2021. The MOI for this region was 5.5 months.

Year-to-date sales for 2024 in Owen Sound & Grey/Bruce were nearing normal levels at 980. New listings were recorded at 2,390, while active listings on MLS® were at 1,178, both considered normal for the area. The MOI was 6 months, indicating a balanced market.

The current real estate landscape is characterised by cautious buyers and motivated sellers. Despite the Bank of Canada’s decision to cut its overnight interest rate to 4.75% from 5%—its first reduction since July 2023—buyers remain hesitant. More interest rate cuts may be necessary to entice buyers back into the market.

Mortgage rates have not decreased enough to alleviate buyers’ concerns about managing significant monthly payments. The high prices of modest luxury homes, often exceeding the million-dollar mark, further contribute to this reluctance. Consequently, sellers are increasingly adjusting their prices to attract offers, with negotiations becoming commonplace once again.

A significant factor driving the increase in listings is the impending renewal of low-rate mortgages taken out a few years ago. Homeowners are finding the new rates and payments less manageable, prompting them to list their properties.

Real estate fundamentally operates on supply, demand, and affordability. The pandemic era saw high demand, low supply, and cheap borrowing costs. Today, demand has waned, supply is ample, and carrying costs are higher, resulting in a slower market.

The market’s future will be shaped by affordability challenges and the need for housing that meets the evolving needs of Canadians. The emphasis will be on intensification and innovative housing solutions. Communities like Collingwood are leading the way by fast-tracking accessory dwelling units and add-on apartments to existing homes.

Imagine transforming a typical town lot with a three-bedroom home into a multi-generational living space with an additional apartment and a stand-alone granny flat. These creative solutions can provide rental income, caregiving options, and financial stability.

The real estate market will rebound, but it will not return to its pandemic-era dynamics. It will evolve, presenting new opportunities for creativity and innovation. As we navigate these changes, the focus will be on meeting the diverse needs of Canadians while ensuring affordability and stability. E