What a rollercoaster 2020 has been. The year started strong, crashed to a halt in the second quarter and then bounced like a ball into the third quarter. Since then, record after record has been set. It has been a great market for sellers, but has been tough on buyers and their REALTORS®. Is there an end in sight?

That is probably the most common question I get from the public, friends, family and indeed my REALTORS® at the brokerage. When you read the market stats below, you will find them incredible. Indeed, they have been. Average sale price is up 28% this year in our area. That isn’t healthy. But the market has been trending that way for a while. Average MLS® sale price has doubled in the last five years. That is a ton of equity for the average homeowner.

But is it sustainable? Where will it stop? The answer is—I am not sure. Price escalations of this type cannot go on forever. However, what cools things down? In our market, we have some grade ten economics at play right now.

While this is a very simplistic approach, I do believe it illustrates what we are experiencing currently in Southern Georgian Bay. Market price for a product like a home is set by a willing buyer, a willing seller, free of duress and with adequate exposure to the market. Simple supply and demand. However, COVID, coupled with some basic market fundamentals have pushed the demand far above the available supply.

For years the trend has been growth in our area. Because, who wouldn’t want to live here? We have terrific amenities, great proximity to major markets, and par excellence lifestyle. Add a pandemic that makes folks realize they can work from anywhere, and you are pouring gas on an already roaring fire.

So, what is going to change? Supply? That isn’t easy. Most shovel-ready developments are getting to market as quickly as possible. I recently had a conversation with a sales team in charge of a new development—they tell me they have 5,000 people on their contact list for the project. Occupancy projection is 2-3 years away. One cannot simply wave a magic wand and produce inventory—it takes years to get a development going. And years again to build and occupy. Supply is not a short-term solution to this imbalance.

So, will demand come to play and balance things out? Maybe. Will people go “back to the office” post pandemic, removing the additional work at home cohort we have been seeing of late? Maybe. Will price increases like we saw this year push some folks out of the market or move them to markets that have a lower average sale price? Maybe.

There are a lot of maybes here. But I always go back to the fundamentals. People want to be here. They wanted to be here pre-pandemic, and they will want to be here post pandemic. Our area is unique, and people know it. And remember, a Toronto dollar still goes a long way here. Folks have done very well on their GTA real estate and can still pocket some dough and buy a stunning property in our area.

Here is the real answer I give: “I don’t know”. In unprecedented times, it is hard to find an expert who can speak with authority on what will happen. Statistically, markets go up and markets go down. Market fundamentals are always at play though, and I believe in the fundamentals of our market.

Short-term, I am not sure what is going to change on the supply and demand curve that will affect the current trajectory of the market. As I write this piece, we had 23 offers on a home in Collingwood that sold 30% over asking. My team all have a stable of eager buyers waiting for inventory. Inventory that is not easy to find, and not easily created. I am not willing to prognosticate and say we will see the same in 2021 that we saw in 2020. I don’t think it is sustainable. Nor do I think that the market fundamentals of our area are weak.

My friend Lindsay Fawcett is a wise gent who knows more about commercial real estate than most of us will ever know. His words ring in my ears in situations like this; “Des—you can only sell in one market. Today’s. You can’t sell in yesterday’s and you can’t sell in tomorrows.” Wise words in unusual times. Right now, folks want to be here, and the market is hot. The rest you will have to read about in our next update.

While I can’t sell in yesterday’s market, I can speak to it, 2020 was a year like no other, with both the very best, and also some of the worst, sales numbers ever.

The year got off to a rocking start, with record January and February volume sales. The two months combined were up 32% from 2019 and up 17% from 2017’s previous high. March sales also began at a record clip, but by the second half COVID’s effects had set in and the month finished down 4% from March 2019. Still, Q1-2020 sales were up 15% from Q1-2019, and down just 3% from Q1-2017’s record.

It was in April that the bottom really fell out of the market with just $31,573,200 in volume: the month’s lowest since 2006 and down 67% from April 2019. Sales picked up in May but were still down 35% from May 2019. It was in June—mainly the second half of the month— that the market turnaround went into overdrive, with a new all-time, regional monthly sales record of $174,058,902: up 84% from June 2019 and up 25% from May 2017’s previous record. So, despite the market hitting bottom in April, Q2-2020’s volume of $278,752,752 was down just 7% from Q2-2019.

And from there, there was no looking back. July saw $251,397,787 in volume, 38% more than June’s short-lived record. August followed suit with a new record of $254,961,103. And September came through with $202,628,924. All totalled, Q3-2020 had $708,987,814 in sales: up an astounding 115% from Q3-2019’s former, all-time, quarterly benchmark. Additionally, Q3-2020’s 1,013-unit sales were up 18% from Q2- 2016’s long-standing quarterly record of 858, as well as up 66% from Q3-2019’s 609.

That brings us to Q4 and yet two more record months in October and November. October’s volume of $212,767,008 and 280 units were up 95% and 21% respectively from the month’s previous high-water marks, while November’s volume of $149,893,476 and units of 189 were up 90% and 11% respectively from the month’s former records.

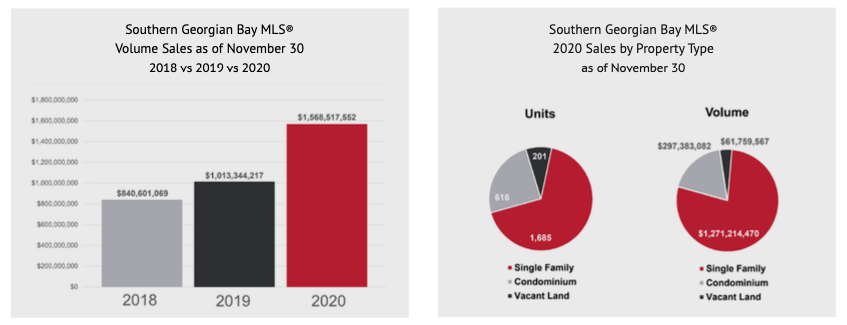

And so, as of this writing (the beginning of December), we have seen a mindboggling $1,568,517,552 in volume sales in 2020: that’s a whopping 55% more than 2019’s record pace at this time. Not only that, but the upturn from June to November gave us $1,245,707,200 in sales: that’s 23% more volume in six months than all of 2019’s previous annual record!

Last but not least, while the Southern Georgian Bay’s projected $1.6+ Billion in sales is incredible, of more interest to homeowners are two other key metrics. First, the sales/listings ratio for the last six months has been 95%: a big-time sellers’ market. And second, our region’s average sale price for the same period has been $710,209: that’s up 105%, 75%, 49%, 37%, and 28% from 2015-2019 respectively. Great numbers indeed for those who own real estate in our market!

In conclusion, 2020 has been a year where we have never been more aware of the importance of home. The numbers are the numbers, but they are only onereflection of a home’s value to us. From my home to yours, I wish you the best for 2021 and hope the country as a whole can breathe a bit easier.